4 Easy Facts About Steve Young Realtor Shown

Wiki Article

The smart Trick of Steve Young Realtor That Nobody is Talking About

Table of ContentsHow Steve Young Realtor can Save You Time, Stress, and Money.The 10-Minute Rule for Steve Young RealtorThe smart Trick of Steve Young Realtor That Nobody is DiscussingNot known Incorrect Statements About Steve Young Realtor The 6-Minute Rule for Steve Young Realtor

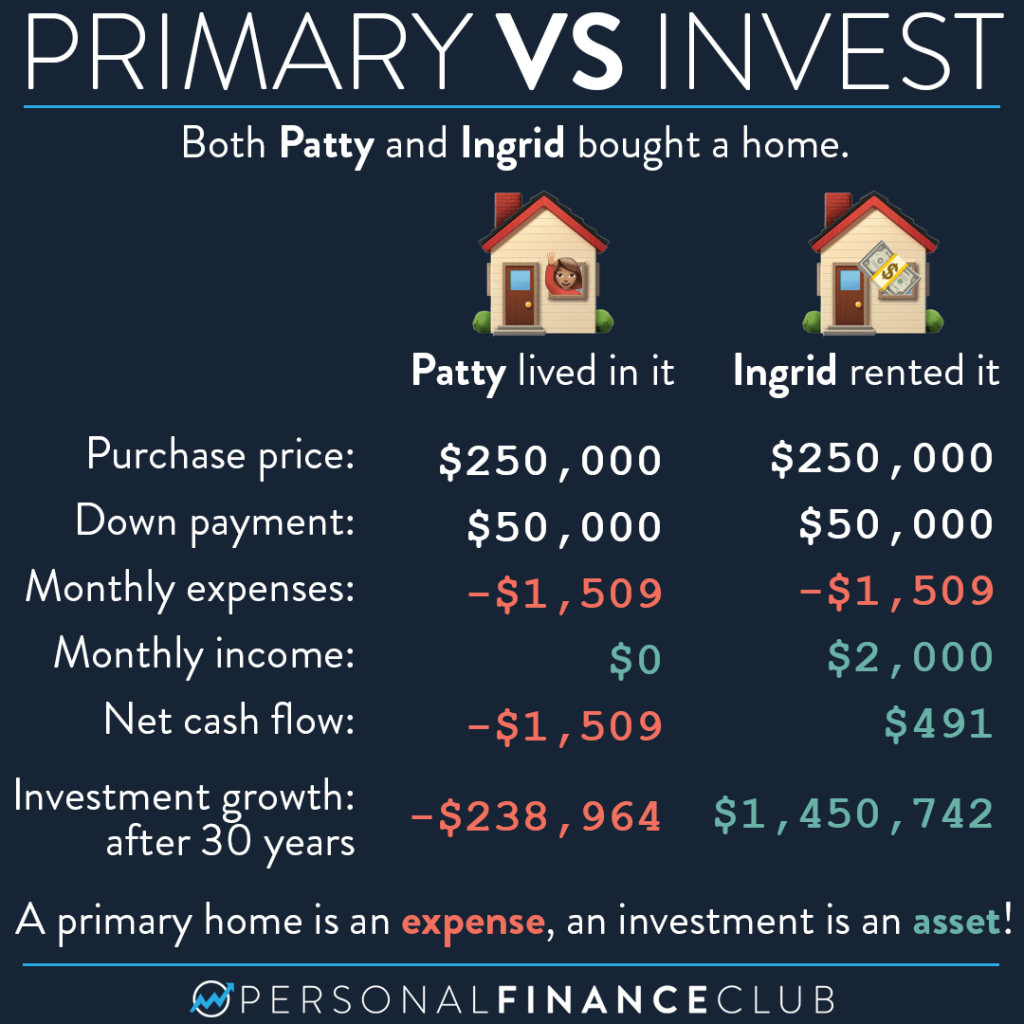

For comparison, Wealthfront's average portfolio earned just under 8% net of fees over the previous eight years. And the Wealthfront return is even more tax obligation efficient than the return you would receive on genuine estate due to the means rewards on your Wealthfront portfolio are exhausted and our tax-loss harvesting.

And also we're discussing individuals who have huge personnels to assist them find the suitable building and make enhancements. It's far better to expand your financial investments You must consider purchasing a private property the very same method you need to believe concerning an investment in a specific supply: as a large threat.

The smart Trick of Steve Young Realtor That Nobody is Talking About

The suggestion of attempting to select the "right" individual building is appealing, specifically when you think you can get a good offer or get it with a great deal of take advantage of. That strategy can work well in an up market. Nonetheless, 2008 educated everyone concerning the dangers of an undiversified actual estate portfolio, as well as reminded us that leverage can function both ways.Liquidity issues The last major disagreement against owning investment buildings is liquidity. Unlike a genuine estate index fund, you can not market your residential property whenever you want. It can be tough to forecast for how long it will consider a domestic home to sell (as well as it typically seems like the a lot more anxious you are to market, the longer it takes).

Attempting to make 3% to 5% even more than you would on your index fund is virtually difficult other than for a handful of actual estate private equity https://steveyoungrealtor.com/ capitalists that attract the finest as well as the brightest to do nothing yet focus on outperforming the market., you ought to not treat your house as a financial investment, so you do not have to restrict your equity in it to 10% of your fluid web well worth).

The Best Guide To Steve Young Realtor

However, if you have a home that rents for less than your carrying expense, after that I would highly prompt you to consider marketing the home and rather purchase a diversified portfolio of low-cost index funds.Throughout the years, realty financial investment has continuously escalated. Some people select to buy a building to rent on a lasting basis, while others go with short-term rentals for travelers and company travelers. One location that has seen significant growth in actual estate financial investment is Las Las vega. From apartments, single-family houses, as well as penthouses to business workplaces and retail rooms, the city has a wide variety of homes for budding investors.

Is Las Las vega actual estate an excellent financial investment? That's why the city is constantly ending up being a top actual estate financial investment location.

7 Easy Facts About Steve Young Realtor Described

In between the notorious Strip, the wealth of hotels, resorts, as well as gambling establishments, first-rate amusement, unbelievable indoor attractions, as well as impressive exterior spots, individuals will certainly constantly be attracted to the city. This indicates you're never ever except visitors seeking an area to stay for a weekend break journey, a lasting rental, or a house to transfer to.

In reality, you can prepare for a consistent stream of people aiming to rent purchase, even your Las Vegas realty investment. What to Search for in a Great Financial Investment Home, Spending in real estate is a significant life choice. To determine if such an investment benefits you, make certain to think about these important points.

The Ultimate Guide To Steve Young Realtor

Kind of Property and also its Attributes, It is very important to recognize what kind of realty building you want to purchase business, commercial, household, or retail. Residential includes residences, a basic human need, so this financial investment is understood to be the most safe with guaranteed returns. The various other three have a tendency to have high risks (such as economic downturn and also jobs), yet they provide higher revenue margins.They can provide you a concept of what's in shop in the area, so you can much better assess if this is an excellent financial investment - steve young realtor. Building Worth, Understanding the estimated value of the property in advance aids you choose whether or not the investment is worth it.

Report this wiki page